David Rook

Chief Marketing Officer

Dave is a veteran marketing and digital platforms expert. His passion lies at the intersection of the creative arts, behavioral economics and social sciences. Dave is our go-to resource for out-of- the box creative, as well as strategically sound yet remarkably innovative approaches to the mundane.

Dave spends his days finding new ways to help drive benefit strategies and desired outcomes through more influential employee communications and decision-making tools.

He works hands-on with our clients to tap into the behavioral insights of their workforces – all in an effort to solve their most difficult communication, enrollment and behavioral modification challenges.

A digital products expert since the early days of the Internet, Dave also leads the development and optimization of our benefit automation and HR technology platforms, including both our desktop and mobile solutions.

Dave’s distinguished career includes brand marketing positions with Leo Burnett (General Motors, Philip Morris), Coca-Cola and AOL. More recently Dave was the General Manager of Consumer Media at Hanley Wood and the Chief Marketing Officer at eCommerce retailer Simplexity.

A sampling of the diverse brands Dave has worked on include:

- Oldsmobile

- Rockford Fosgate Audio

- Marlboro

- Sprite

- Minute Maid

- AOL

- City’s Best

- Moviefone

- Architect Magazine

- ePlans.com

- Floorplans.com

- Homeplans.com

- Verizon

- T-Mobile

- When.in

|

- GMC Truck

- Celebrity Cruise Lines

- Coca-Cola

- Barq’s

- Wendy’s

- Digital City

- MapQuest

- Builder Magazine

- Remodeling Magazine

- Dream Home Source

- Houseplans.com

- Wirefly.com

- Sprint

- Urgent.ly

|

Dave received his MBA at Georgetown University and his undergraduate degree from the Walter Cronkite School of Journalism and Telecommunications at Arizona State University.

When not at the JP Griffin Group, you might find Dave out on the golf course or at a live music venue, all the while checking scores for his beloved perennial underdog, the Chicago Cubs.

In a perfect world, personal life and work-related responsibilities are in absolute harmony. There's no stress, no job dissatisfaction, and no reduced productivity. In a perfect world, when we list our priorities, we give equal weight to home and work, and our scale is in balance.

The savvy employer recognizes that more often than not, time is more important than money to employees. The ability to choose a work schedule, telecommute, or cut back on hours, without fear of monetary loss or employer repercussion, is a major perk. Having the opportunity to be flexible results in less stress for your employees, which results in higher productivity, less turnover, and an overall happier workplace.

Here are a few ways you can use the gift of time creatively to make your workers’ lives easier.

Read More

The culmination of tax season reminds employees and employers of every political stripe just how much in profits and wages are sent along to Uncle Sam long before they have a chance to reach anyone's checking accounts or business coffers.

With that in mind, as well as the competitive labor market, employers and employees alike are keen to negotiate competitive benefits packages that can act to offset lower salaries with tax-exempt perks.

Nearly every business has explored or offers some form of Health Savings Account (HSA) or Flexible Savings Account (FSA) to its employees if possible, but those are just the tip of the iceberg when it comes to the possibilities for tax-exempt compensation. Here are five other great tax-exempt employee benefits that any business can use to attract and retain top job candidates while saving money for both parties.

Read More

Are you the only person in the role of human resources at your company? Don't worry, you’re not alone. According to research from the Small Business Association's SCORE Association, human resource work takes up 25 to 35 percent of a small business owner’s schedule and almost a quarter of that time is spent handling paperwork for their employees.

Many businesses are choosing to forego a large human resources department in favor of hiring just one person who can perform HR duties as well as other responsibilities. For example, it's not uncommon for sole HR representatives to train new employees, recruit prospective new hires, manage conflict, handle payroll and administer health benefits.

We know that juggling all of these roles can be exhausting, regardless of whether you are new to the company or a seasoned professional. So are you an HR department of one? If so, below are some checklists and hints that will help you thrive in your current role.

Read More

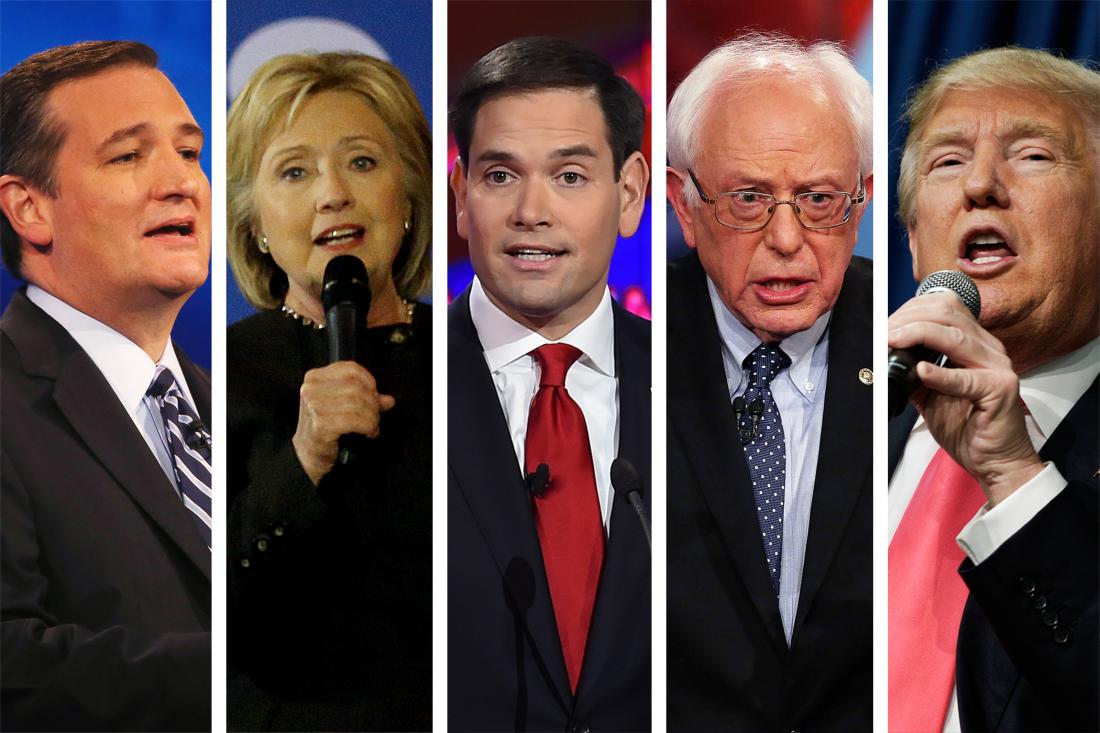

The healthcare debate hasn't been as tumultuous this election cycle as it has been in the past, but regardless of who sits in the Oval Office in January, there will be changes in employer sponsored healthcare. Here's what you need to know about potential legislative changes and employee health benefits.

The Democrats

Hillary Clinton:

After years of championing a single-payer system, Clinton shifted her stance to fully support the Affordable Care Act with a plan to extend current legislation. She has stated that building upon the Affordable Care Act is a more practical solution than instituting a single-payer system, but acknowledges flaws in the existing ACA. Notably, high deductibles and premiums. Her plan incorporates increased tax credits to offset high premiums and other out-of-pocket costs. She also plans to "fix" the "family glitch" so that families can make up the gap in costs between employer coverage and health care costs. Under Clinton's plan, little will change for employers but consumers can expect to see relief in the form of expanded public options and tax credits.

Read More

Despite healthcare reform, which naturally led most reasonable people to believe that runaway healthcare costs were finally going to be tamped down, the cost of obtaining health insurance is still very much on the rise. In fact, from 2006 to 2015, the average out-of-pocket costs per worker rose almost 230 percent, according to a recent Kaiser Family Foundation report.

No matter if someone is acquiring coverage on a state or federal exchange, or if they are obtaining coverage through an employer-sponsored plan, most everyone is feeling the pain.

In the case of workers who are covered by an employer-sponsored health plan, increases are likely coming on two fronts; higher premiums and higher deductibles.

Higher Premiums

While health plan premiums paid by employers are rising this year at lower rates than in year’s past, they are still outpacing inflation. No longer able to absorb these constant increases all alone, these growing expenditures are almost always now shared between employer and employee.

Read More

Should Vaping be Encouraged as a Smoking Cessation Tool?

A reader of last week’s blog post on vaping asked us if employers should actively promote e-cigarettes in their wellness programs as a smoking cessation tool. This is an excellent question. It’s admittedly tough to ascertain if e-cigarettes are going to be the next major health hazard or the most effective smoking cessation technique ever created. Unfortunately, there’s not a straightforward answer to this question, but we will attempt to answer it as best we can.

What is Vaping?

For the uninitiated, vaping is the act of inhaling atomized liquid, usually nicotine dissolved in propylene glycol plus flavoring and colors. The device used for this activity is called an e-cigarette; a battery-operated device, often shaped like a cigarette, which is designed to deliver nicotine in the form of an inhalable vapor rather than tobacco smoke.

Read More

E-cigarettes Remain a Dilemma for Employers

Electronic cigarettes, or vape pens, don’t contain tobacco and they don’t produce smoke, yet they do contain nicotine, and this has left insurers and employers in a quandary. Should “vapers”, as these people are commonly called, be categorized as smokers, and therefore be penalized with higher insurance rates?

The Categorization Quandary

Despite the growing popularity of vapers (they’ve gotten so popular that even icons like Leonardo DiCaprio are comfortable “vaping” in public), they present a somewhat troublesome gray area to insurance companies. This has left employers wondering if their employees who vape are considered smokers and if so, by whom.

Some businesses have weighed-in on the matter. According to the Wall Street Journal, Wal-Mart and UPS, for example, categorize vapers as smokers, and accordingly charge them higher insurance premiums. Cleveland Clinic, which refuses to hire smokers, similarly won't hire e-smokers, while CVS Caremark doesn't allow employees to use e-cigarettes at its corporate campuses. Starbucks bans e-cigarettes for employees and customers; and almost every state has enacted disparate legislation to regulate where e-cigarettes may and may not be used.

Read More

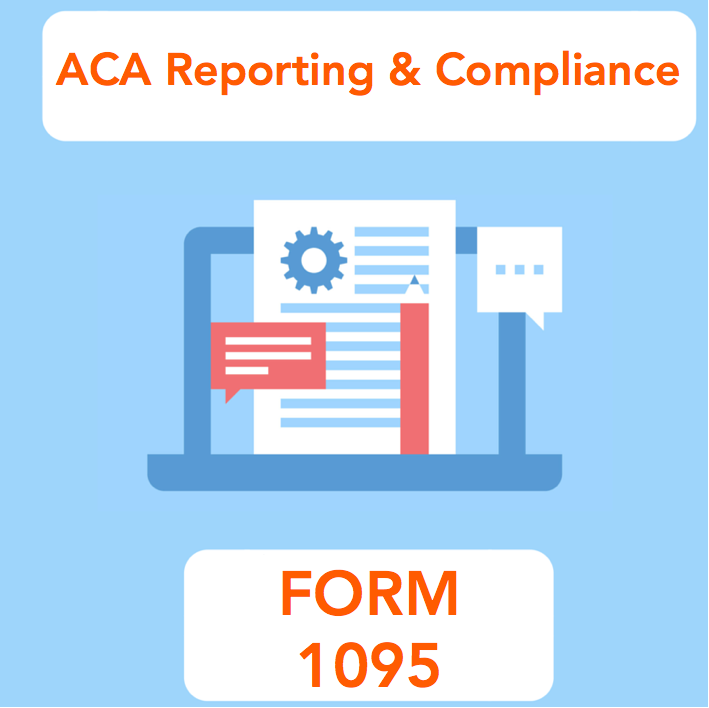

Form 1095 FAQs - ACA Reporting & Employee Benefits Compiance

If you are struggling with ACA reporting forms 1095 and 1094, you’re not alone. Form 1095 is the first new major tax form to be introduced in the U.S. in more than 70 years, making it a significant source of concern for many employers.

Rest assured, with the new deadline of March 31st, 2016 to distribute 1095 forms to your employees, you still have time, but you do need to get moving. And since the arrival of the forms in the mail may raise questions, we recommend that you proactively reach out to your workforce to help them understand what they'll be receiving.

Read More

Zenefits: Whatever Happened to "Under-Promise and Over-Deliver?"

The resignation this week of Parker Conrad as the CEO of tech darling and HR administration upstart Zenefits should hopefully serve as a wake-up call to other technology providers in the fledgling health insurance and human resources technology sectors.

The digital transformation of these industries is inarguably long overdue. Many group insurance brokers fear this disruption, still clinging to vestiges of the past. But long gone are the days when brokers could retain clients simply based on relationships: the annual round of golf, dinner out with the spouses, and a slap on the back just don’t cut it any more. Results matter.

Read More

How to Best Reach a Digital-Savvy Workforce

According to a recent Gallup poll, little progress is being made by U.S. companies hoping to improve employee engagement levels. In 2015, 32 percent of employees were classified as “engaged,” based on a number of measures such as believing their opinions count at work and having the opportunity to do what they do best every day. This figure represents only a 0.5 percent increase over 2014.

The majority of workers, 50.8 percent, were classified as “not engaged,” while an alarming 17.2 percent were classified as “actively disengaged.”

Read More